Are You Paying Too Much Property Tax?

Every Year Nebraskans wait patiently to see if their property taxes will go up. It’s a local ritual that is as Nebraska as The Huskers, College World Series, or Warren Buffet. While we aren’t going to discuss if Nebraskan’s Property Taxes are out of line, let’s remain vigilant so we aren’t overtaxed.

Preliminary (Estimated) Real Estate Property Taxes were revealed January 15, 2020 for Douglas and Sarpy Counties. Since Nebraska Property Taxes are paid in arrears the 2020 Valuations will be paid in 2021. This preliminary values gives property owners the ability to review and challenge valuations.

The process for challenging Sarpy County Property Valuations is pretty informal. “Just call, or stop by the office, or Ask the Assessor by email and have the appraiser explain to you how your value was determined.” (Sarpy Assessor Website). Just go to Sarpy County Assessor for more info.

The Douglas County Assessor has a more defined process for challenging your preliminary valuation. You have until Feb 3, 2020 to call and set a meeting. If you don’t set a meeting by then you can email, mail, or drop your info at the Assessor’s Office. Go to Douglas County Assessor for more info.

HOW TO CHALLENGE YOUR VALUATION

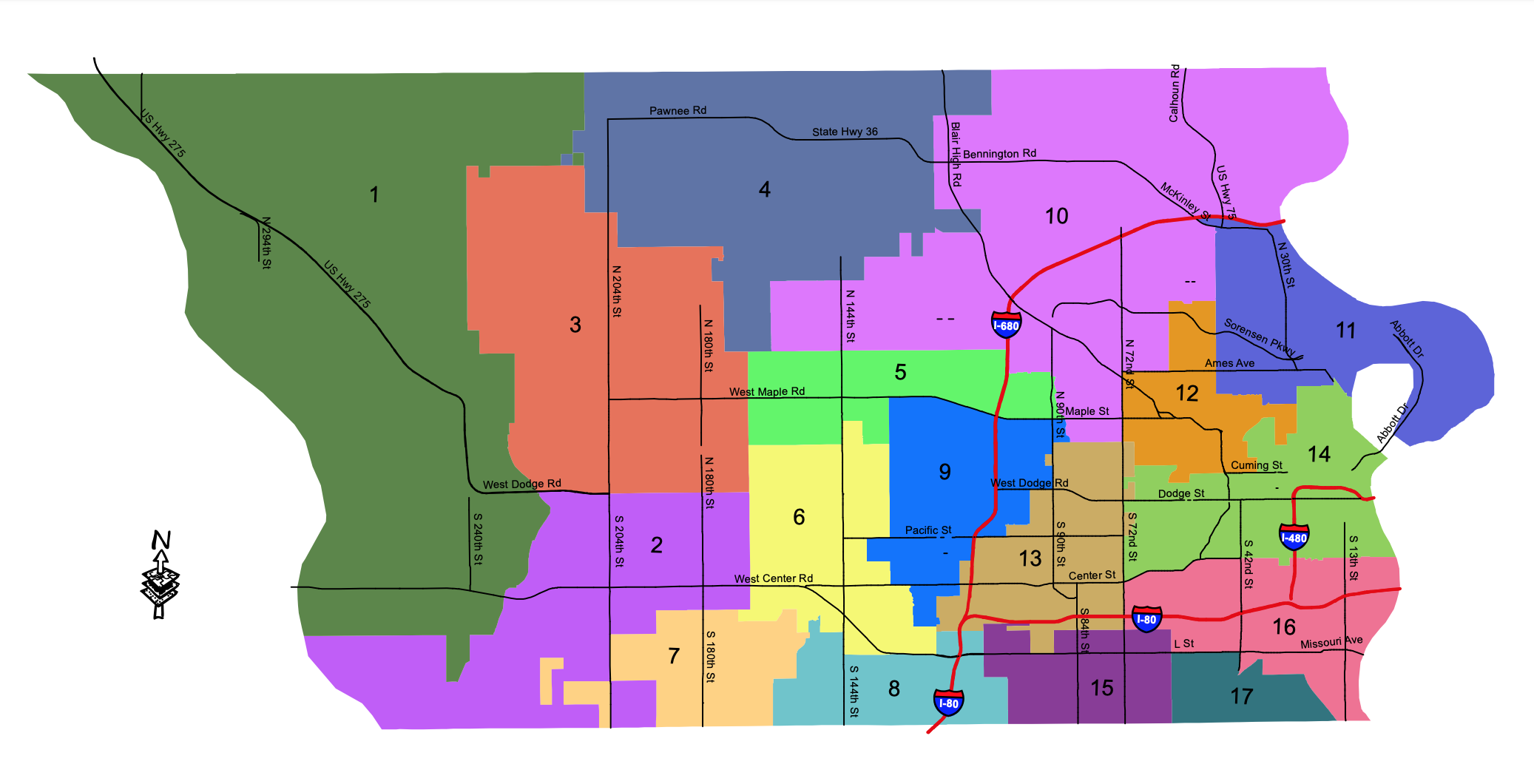

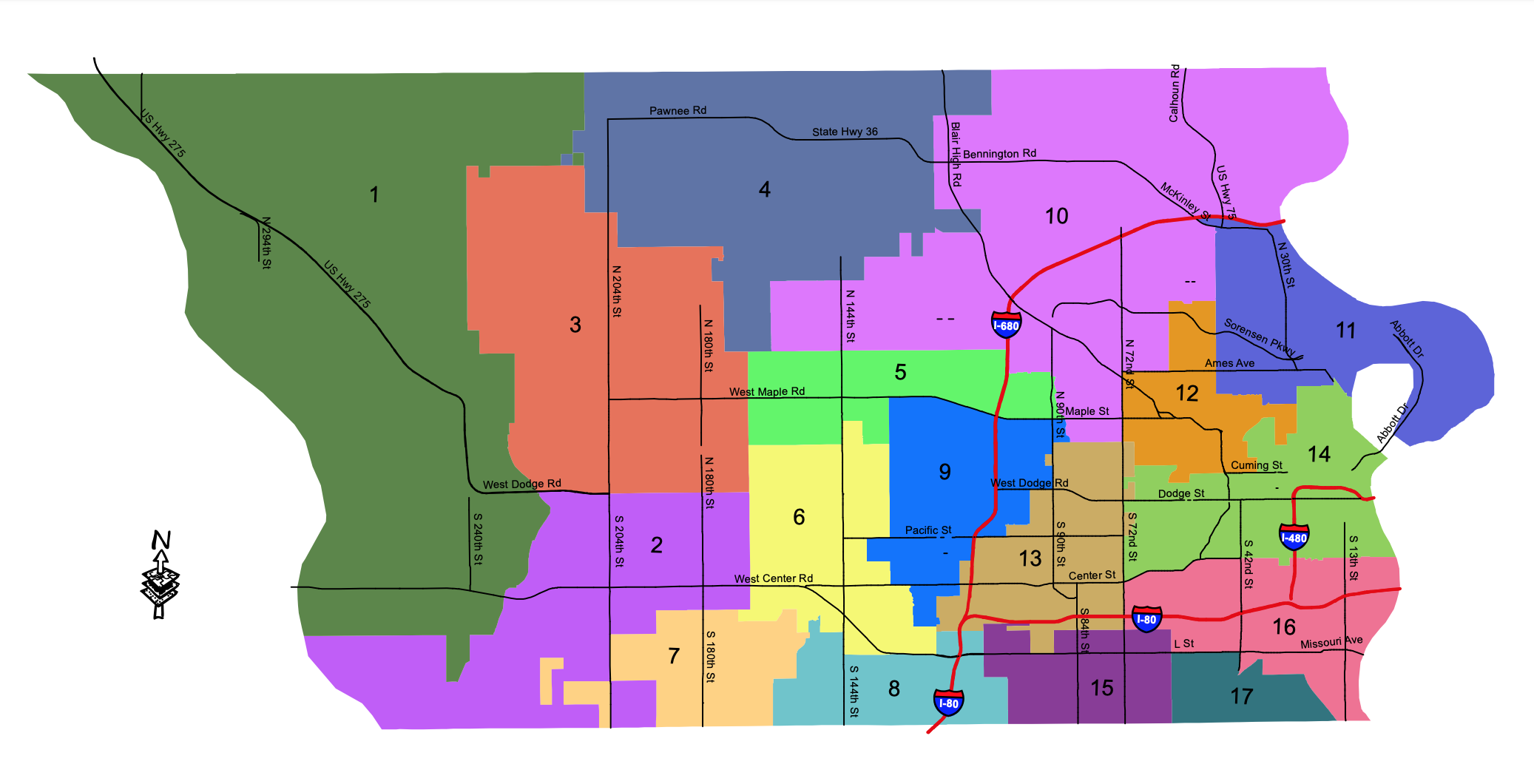

In order to challenge the valuation you need to have proof that the Assessor made a mistake. Douglas County Assessor uses Mass Appraisal to valuate large areas of real estate. They divide Douglas County into 17 areas and evaluate sales from the previous areas. If prices have increased or decreased in an are then they raise the valuations and lower them if the sales prices have declined. They make an effort to then go by neighborhood, but the valuations are still very broad in scope and many are incorrect.

What does it mean for you? If you have the ability and desire to buy a home now, don’t let a fear of recession or falling prices hold you in limbo. Economists expect home values, as well as rent prices, to continue rising. So you’ll likely pay more the longer you wait.

HOW CAN TEAM BOBER HELP?

Most people see an increase in their Preliminary Valuations and automatically think they are being treated unfairly. The reality is property values are rising so are valuations. However, the County Assessor sometimes make a mistake. The question is, how do yo know if your valuation is wrong.

Steps to Take:

- Call Team Bober (402) 312-5076 to Discuss

- We will Have an Informal Phone Conversation

- Team Bober will Conduct a Preliminary Property Evaluation

- We will have a Follow Up Phone Call to Explain Valuation

- Determine if Your Valuation should be Appealed

- Hire Team Bober to Complete a Broker Price Opinion (BPO)

- We provide BPO & coaching before you meet with County Appraiser

STAY CALM AND PROVE YOUR CASE

Appealing you Preliminary Valuation is a process that carries some risk. If you have been significantly overtaxed then we help you evaluate your options. The County Assessor doesn’t care how much this will increase your taxes or if your neighbor’s house only sold for X. They can only evaluate property with the facts they possess and its your job to provide your own facts if they are wrong. So be prepared to correct any inaccuracies and provide comparable sales to support your proposed value.

Nebraska law was recently changed to allow a Broker’s Price Opinion as an official evaluation. It’s cheaper than an appraisal, but a very effective tool to show a professional price opinion. We can help provide BPO if you hire Team Bober to appeal your valuation

Chris Bober is an Associate Broker and leader of Team Bober, a group of REALTORS® at Nebraska Realty in Omaha, NE offering a wide range of real estate services including home and new construction sales, land and farm sales, and auctioneering services. For more information please call Chris at (402) 312-5076 or email him at Chris@NebraskaRealty.com. TeamBober.com